The Cognitive Power Curve: Why Intelligence May Be Extended and Exponential

Hypothesis: Intelligence, once extended, behaves like wealth in its societal effects

The content for today’s Substack came to me earlier today while considering (1) the extraordinary prevelance of power curves in our lives, related to ideas such as ‘multiplier effects,’ but also increasing polarisation; (2) the latest WEF Future of Jobs Report:

The 80:20 Rule

Wealth distribution follows a strikingly familiar pattern: a power curve, where a small minority holds disproportionate resources. This empirical fact is uncontroversial, and it has long been formalised as the Pareto Principle or 80:20 rule, named after economist Vilfredo Pareto

In the 19th century, Vilfredo Pareto (above) observed that 20% of the pea pods in his garden contained 80% of the peas. Pareto also happened to be an economist, and the pea pod discovery got him thinking. In 1896, he published a paper demonstrating that around 80% of the land in Italy was owned by 20% of the population.

Since then, the principle has been applied to a wide range of domains, including business (e.g., 80% of sales come from 20% of clients), software (80% of errors come from 20% of bugs), and productivity (20% of activities yield 80% of results). It captures a fundamental aspect of power-law distributions: that small, highly efficient or influential subsets can produce outsized impact.

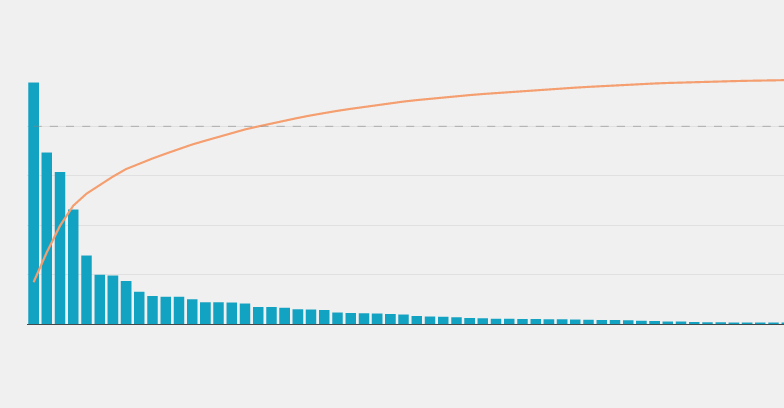

Visualising a Pareto analysis of data allows you to quickly pick out where you should focus your time and resources. Take, for example, this dataset of consumer complaints submitted to the Consumer Financial Protection Bureau (a government agency working to protect consumers in the financial sector). Each complaint is bucketed into one of 94 distinct issue types, which might be too many for the CFPB to focus their policy efforts on all at once. Looking at a Pareto chart of consumer complaints will help them figure out where to start.

What about 80:20 for IQ Impact?

I would like to suggest there is an analogous possibility in cognition. Could intelligence itself - like wealth or productivity - follow a power-law distribution in terms of impact, if not test score frequency? Traditional IQ scores are normally distributed, but real-world cognitive impact might not be. When amplified by technological tools, information networks, and knowledge systems, individual cognitive influence could scale exponentially, mirroring the wealth curve.

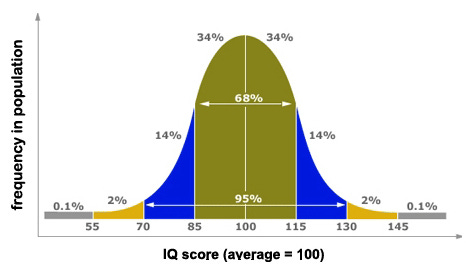

Bell Curve vs Power Curve

A normal distribution (or bell curve), like the one we see in IQ test scores, assumes most people cluster around the average, with symmetrical tails tapering off on both sides. It’s ideal for measuring traits that are relatively stable and naturally constrained - like height, or raw test performance - where extreme values are rare.

A power-law distribution, by contrast, is highly skewed: most people are near the bottom, but a small number account for the vast majority of the quantity in question - be it wealth, followers, scientific citations, or influence. There’s no ‘average’ in the same way; instead, a small ‘elite’ dominates the landscape.

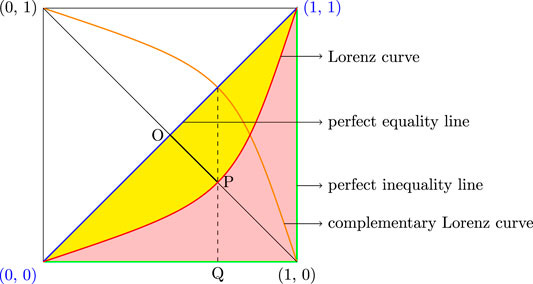

This can be visualised using a Lorenz curve, which shows the cumulative distribution of wealth (or, in our reinterpretation, cognitive impact). The diagonal line represents perfect equality, while the curved line shows actual distribution. The horizontal axis shows the cumulative proportion of the population (from poorest to richest), while the vertical axis shows the cumulative share of wealth - or cognitive impact - held by that proportion. The further this curve bends from the diagonal, the more unequal the distribution - and the more extreme the power-law dynamic. While IQ is normally distributed, extended intelligence - amplified by platforms, networks, and technology- may follow this steeper curve. A small fraction of individuals (right of the inflection point P) where impact accelerates) may exert vast influence.

The Smart Fraction Theory

Enter the Smart Fraction Theory, advanced by Professor Heiner Rindermann. It states that approximately 10-15% of individuals with high cognitive ability (IQ scores above about 115) disproportionately drive societal success - innovation, economic growth, and institutional development. Yet IQ scores themselves don't show a classic power-law distribution. Instead, IQ is normally distributed, lacking the exponential take-off characteristic of wealth distribution.

Extended Cognition

This mismatch suggests a compelling hypothesis: intelligence, if restricted to traditional psychometric IQ, misses something crucial. Perhaps intelligence is best understood as extended - integrated deeply with technologies, apps, knowledge management systems, and networks. This perspective aligns with Andy Clark and David Chalmers' concept of 'extended cognition', which argues that cognitive processes extend beyond the individual's mind into external tools, resources, and environments (Clark & Chalmers, 1998). From this viewpoint, intelligence encompasses not only internal cognitive capacities but also external systems, networks and technologies - now increasingly AI driven - that enhance thinking, problem-solving, and decision-making capabilities.

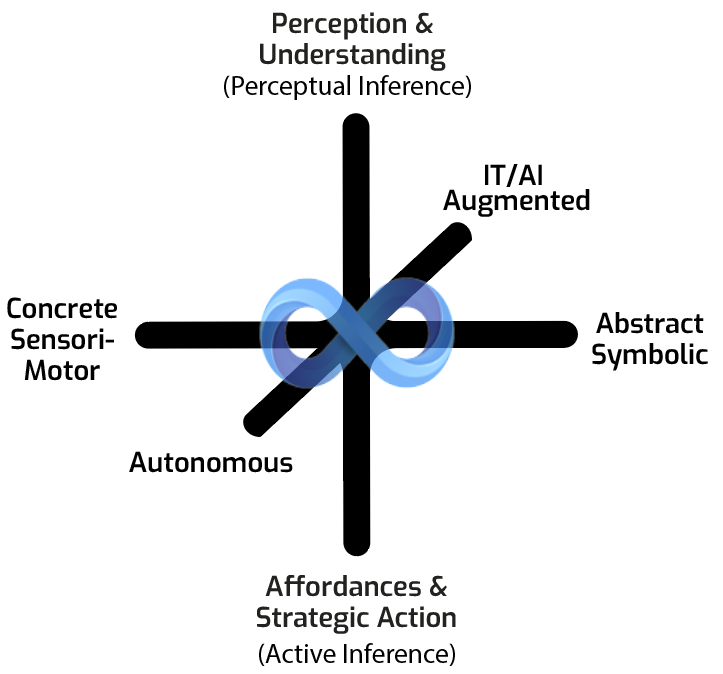

In my Trident G theory of intelligence, this is represented by one of the key processing axes:

In today's hyperconnected world, cognitive influence is increasingly magnified by technological systems and social networks. Think Elon Musk. His impact isn't merely raw IQ - it's intelligence amplified exponentially through technological reach, data analytics, AI-driven decision-making, and social media platforms. Musk sits atop the cognitive power curve precisely because his intelligence is extended into technological and informational ecosystems.

When we redefine intelligence to include these extended cognitive systems—what we might term ‘Gx’ we see a power-law emerge clearly. The smart fraction thus becomes a cognitive elite whose exponential impact is driven by leveraging extended intelligence technologies and social connectivity.

Empirical Support for the Smart Fraction Theory

Recent research by Kirkegaard and Carl (2022) robustly supports the Smart Fraction Theory. Their comprehensive review found consistent evidence that the cognitive elite- which they investigate as the top 5% in cognitive ability - significantly predicts national outcomes, including economic prosperity, innovation and societal stability. This research complements foundational insights from earlier seminal works by Rindermann et al. (2012), reinforcing the theory's relevance to understanding societal advancement through cognitive leadership.

Implications of this research are significant:

Traditional psychometric IQ underestimates real-world cognitive impact. An exponential fraction may have an equivalent of an IQ score of 200+ (if we were to map IQ scores to the power curve beyond the inflection point.)

Extended intelligence provides a clearer predictor of societal influence and innovation.

Recognising intelligence as a power-law distribution calls for rethinking educational and societal investments to amplify extended cognitive capacities.

Could this cognitive power curve be the key to understanding modern success dynamics?

Ideas for Reflection

Could we use technology and social media to 'bootstrap' our way along the cognitive power curve beyond the inflection point? If extended cognition includes access to information systems, collaborative networks, and cognitive scaffolding tools, then leveraging these resources may allow individuals to shift their position - even in the absence of traditional markers like high psychometric IQ or elite education.

This raises an important question: to what extent does the smart fraction overlap with the wealthiest fraction in the power curve? Is cognitive elite status locked in by family wealth, or can it be earned through intentional technological augmentation and knowledge curation? While the initial conditions of wealth may enable better access to tools of extension, the potential of digital democratisation through open-source tools, online learning, and AI-driven platforms suggests the curve is not fixed.

Additionally, what is the feedback loop between engaging with advanced technological systems and the development of intelligence itself? Can interacting with complex tools, platforms, and information networks augment not only performance but also core capacities like working memory, reasoning, and problem-solving? This would suggest a kind of "reciprocal scaffolding"— where tech or smart-systems use not only extends cognition but refines it over time.

And what does this mean for policy? If extended intelligence can be trained or enhanced, what role should education and public infrastructure play in enabling people to access the means to amplify their Gx? Should digital literacy, cognitive offloading tools, AI fluency, and professional networking & media use be considered central pillars of future cognitive development?

Let's discuss! Please share any comments below.

References

Here are some seminal references related to the Smart Fraction Theory, exponential wealth distribution and extended cognition:

Smart Fraction Theory:

Kirkegaard, E. O. W., & Carl, N. (2022). Smart Fraction Theory: A Comprehensive Re-evaluation. Comparative Sociology, 21(6), 677–699. https://doi.org/10.1163/15691330-bja10063

Rindermann, H. (2012). Intellectual classes, technological progress and economic development: The rise of cognitive capitalism. Personality and Individual Differences, 53(2), 108–113. www.doi.org/10.1016/j.paid.2011.07.001.

Exponential Wealth Distribution and the Pareto Principle:

Pareto, V. (1897). Cours d'économie politique. F. Rouge.

Vilfredo Pareto introduced the concept that wealth distribution follows a predictable pattern, now known as the Pareto Principle or the 80/20 rule, where approximately 20% of the population controls 80% of the wealth.

Piketty, T. (2014). Capital in the twenty-first century (A. Goldhammer, Trans.). Belknap Press of Harvard University Press. (Original work published 2013)

Thomas Piketty's extensive analysis of wealth concentration over time demonstrates how wealth distribution often follows a power-law distribution, highlighting the exponential nature of wealth accumulation among the richest fractions of society.

Extended Cognition:

Clark, A., & Chalmers, D. (1998). "The extended mind." Analysis, 58(1), 7–19. Consciousness Network+5Wikipedia – Die freie Enzyklopädie+5Wikipedia+5

This foundational paper argues that cognitive processes can extend beyond the individual's mind to include external tools and environments, laying the groundwork for the theory of extended cognition.

These references give us foundational insights into the interplay between cognitive abilities, wealth distribution patterns, and the extension of cognitive processes beyond the individual.

Interesting stuff. One thing that immediately comes to my mind is how technology amplifies memory. IQ training improves WM, strategy improves overall functioning, but what occupies WM is determined by retrieval and long-term memory. Technology has amplified our memory by allowing us to look things up. But, with the advent of AI, we can now collaborate, discuss, argue, and extend our memories. That can have a far greater effect for IQ vs. simply looking things up.